Batch auctions

Continuous limit order book designs leave room for arbitrage, incentivizing high-frequency trading and resulting in sub-optimal pricing for traders. Batch auctions are a new type of trading mechanism which addresses these flaws by grouping orders into discrete time intervals. This approach eliminates the arbitrage opportunities inherent in continuous limit order book designs and delivers more beneficial outcomes for traders.

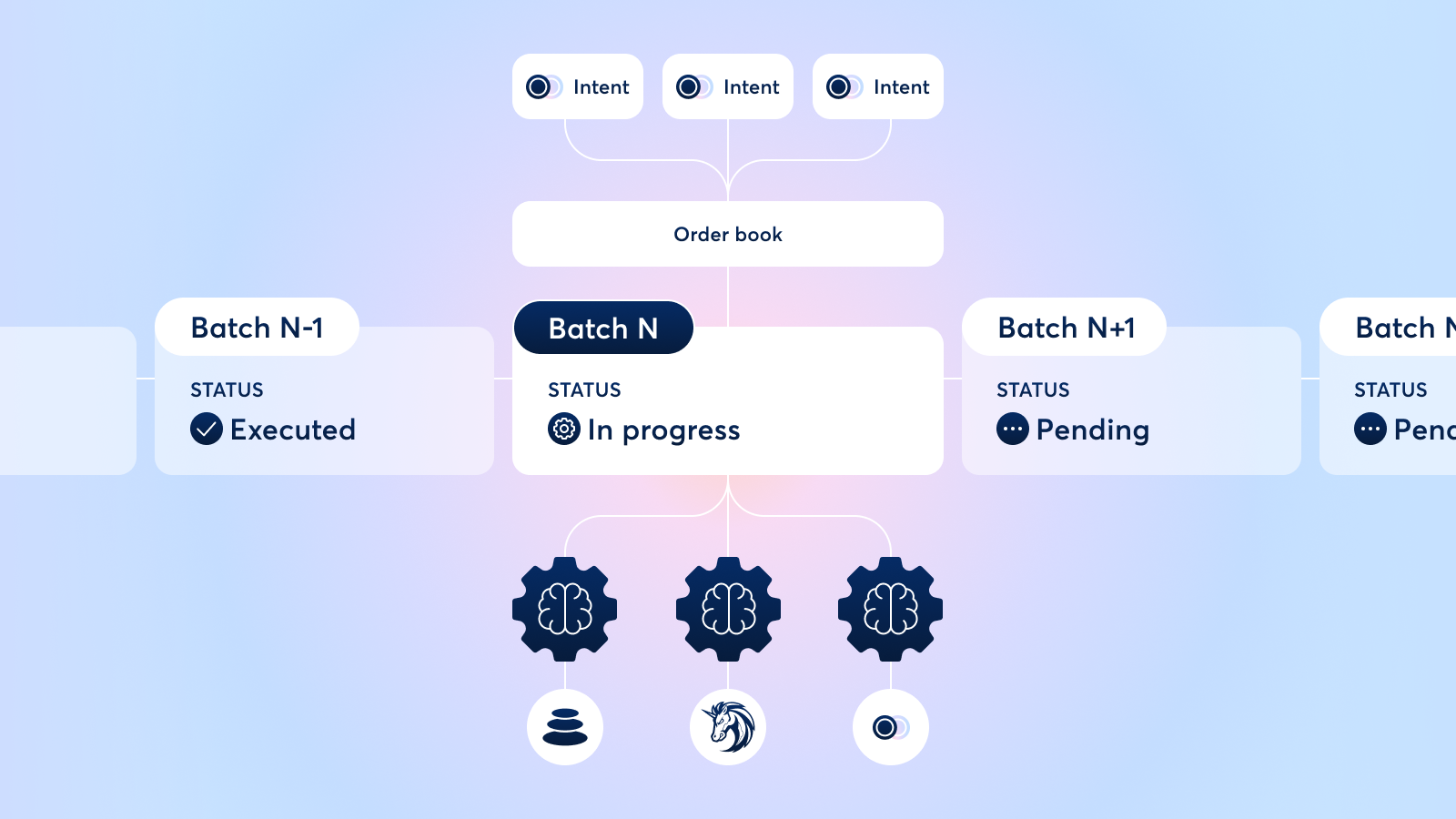

CoW Protocol collects and aggregates intents off-chain and settles them together in groups, known as batches. The right to settle the orders in a batch is then "auctioned off" through a competition to the solver offering the most surplus for the orders in the batch.

Batch auctions provide several benefits:

- MEV Protection: Batch auctions allow for Uniform Clearing Prices (UCPs), where an asset that appears multiple times across orders in the same batch settles for a consistent price. This makes transaction order irrelevant within the block, undermining the ability for MEV bots to extract value.

- Coincidence of Wants: When multiple orders trade the same assets within a batch, there may be an opportunity for a peer-to-peer swap that doesn't tap on-chain liquidity. The mechanism of Coincidence of Wants (CoW) relies on batch auctions.

- Enforcing the Ethereum Best Bid Offer (EBBO): Ensuring that the settlement solution is at least as good as the on-chain price a user could get directly from an AMM.