CoW Protocol

CoW Protocol is a meta-DEX aggregation protocol that leverages trade intents and batch auctions to find users better prices for crypto trades.

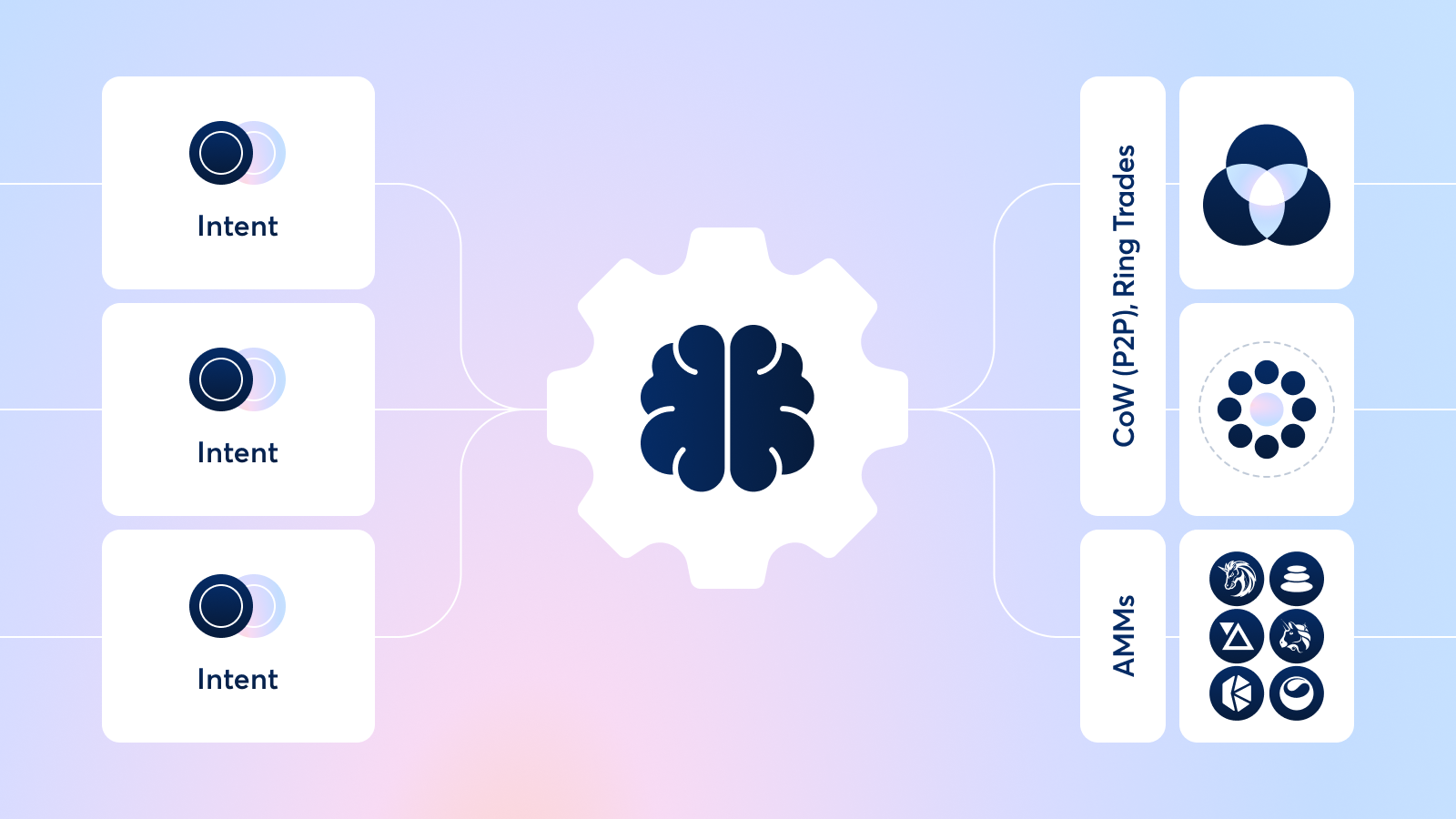

The protocol relies on third parties known as "solvers" to find the best execution paths for trade intents — signed messages that specify conditions for executing transaction on Ethereum and EVM-compatable chains.

Upon first receiving a user intent, the protocol groups it alongside other pending intents in a batch. When executing trade intents, solvers first try to find a Coincidence of Wants (CoW) within the existing batch to offer an optimal price over any on-chain market maker. If the protocol does not find a CoW, the solvers search all available on-chain and off-chain liquidity to find the best price for a set of trade intents within a batch.

Liquidity sources include:

- AMMs (e.g. Uniswap, Sushiswap, Balancer, Curve, etc.)

- DEX Aggregators (e.g. 1inch, Paraswap, Matcha, etc.)

- Private Market Makers (e.g. 0x, Hashflow, Bebop, etc.)

This delegated trade execution architecture makes CoW Protocol a meta-DEX aggregator, or an aggregator of aggregators.

To learn more about the concepts CoW Protocol makes use of, see Concepts.

For more info on how to use CoW Protocol or CoW Swap, see Tutorials.

To dive into the technical details, see Technical reference.